January 14, 2013 1:20 pm (Manila)

Second half is out at +33 pips. Took it out as the pair is on the oversold level already and might be due for a correction.

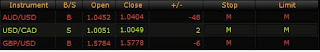

Trade Summary:

1st Half: +30 pips

2nd Half: +33 pips

Total: +63 pips

============================================

January 11, 2013 4:00 am (Manila)

Finally, a trade that's intended to be a short-term trade hit its Limit 1 at

+30 pips.

Second half stops are moved to breakeven making the trade risk-free.

============================================

January 8, 2013 6:24 pm (Manila)

Ivey PMI came out beating expectations giving the CAD a bullish push but still failed to get the pair to break the range.

Trade is currently at +19 pips/lot. I am keeping this trade - hopefully at least day more before the chaos of tomorrow.

============================================

January 7,2013 2:30pm (Manila)

SELL USD/CAD @ 0.9873

Stop - 0.9920

Limit 1 - 0.9843

Limit 2 - 0.9813

Later tonight, the Ivey PMI survey will come out with numbers good for the CAD.

On the Hourly chart, a pair of shooting stars formed. Technical indicators also indicate room for a downward trend in the short term.